The District of Sicamous, in accordance with Sections 94 and 227 of the Community Charter, hereby gives public notice of District of Sicamous Revitalization Tax Exemption Bylaw No. 1059, 2024 which will be considered for final adoption on March 27, 2024 at 5 p.m. in council chambers (446 Main Street). The public is encouraged to attend in-person or online via Zoom.

This Bylaw is being considered for the following reasons and objectives:

Objectives of the Revitalization Tax Exemption Program

The revitalization tax exemption program established under this Bylaw is intended to generate economic growth, new investment, community redevelopment, revitalization and purpose-built rental housing as prioritized in the Official Community Plan.

Accomplishing the Objectives

Council has identified areas where there are opportunities for commercial, industrial, hotel and purpose-built rental housing development and wishes to encourage revitalization of those areas through incentives for the success of the local economy and the enhancement of business, social and cultural, government and residential activities and thus achieve Council’s objectives. Council wishes to establish a revitalization tax exemption program to reinforce and promote property investment, revitalization and purpose-built rental housing.

Eligible Properties and Terms of Tax Exemptions

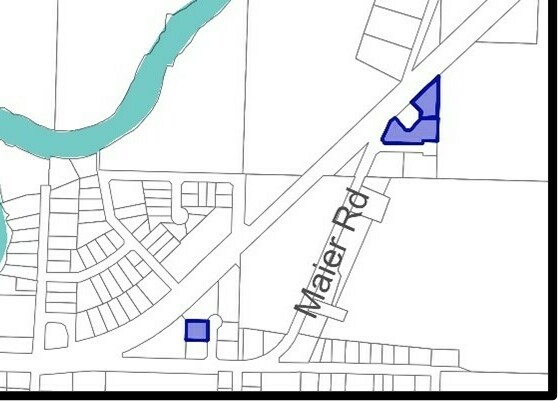

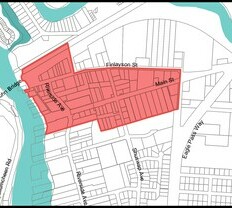

To be eligible for the tax exemption, an applicant must own a property located within one of the Revitalization Areas as identified in Schedules C, D, E or F of Bylaw No. 1059, 2024. The revitalization tax exemption program provides for a tax exemption for projects located within the Town Centre, Industrial, Hotel Development, and Purpose-Built Rental Housing Development Areas, as illustrated below:

|

Area Name |

Details – Bylaw No. 1059 |

|

|

Town Centre |

Minimum construction value: $100,000 Area: see map Exemption: Ten-year (10) municipal tax exemption, as follows:

Exemptions are not available for:

|

|

|

Industrial |

Minimum construction value: $100,000 Area: see map Exemption: Ten-year (10) municipal tax exemption, as follows:

Exemptions are not available for:

|

|

|

Hotel |

For construction of an eligible Hotel Development with not less than 25 sleeping units. Area: development within the District of Sicamous boundary Exemption: Ten-year 100% municipal tax exemption |

|

|

Purpose-Built Rental Housing

|

Project with ten or more Dwelling Units that are intended to be used for rental housing. Area: development within the District of Sicamous boundary Exemption: Ten-year 100% municipal tax exemption To receive this tax exemption a Housing Agreement must be registered on title for a minimum term of twenty-five (25) years and include the following:

|

|